LEARNING OBJECTIVES FROM THIS ARTICLE:

One of the biggest hurdles to overcome while on your journey towards financial freedom is paying off all the debt you had to accumulate in order to, well, start the journey towards financial freedom (don’t you hate catch-22’s). Student loans, car notes, and living expenses all quickly piled up right at the moment you were taking your first steps into adulthood, but you don’t have to let these debt burdens from the past define your future!

By following the Debt Snowball method, one of the most popular and easiest ways to pay down debt, you can jumpstart your debt-free journey and reach your financial goals in no time!

What is the debt snowball method?

The debt snowball method is a debt payment strategy where you pay off your debt in order from the smallest amount owed to the largest amount owed irrespective of the interest rate.

The debt snowball method has proven to be successful for many people striving for financial freedom because you can see your progress over time and experience the satisfaction of paying off each debt. On the flipside, by using the debt snowball method, that means you’re not paying off your debt with the highest interest rates first, which could lead you to possibly paying more money over a longer period of time due to interest.

How does the debt snowball method work?

The beauty of the debt snowball method is in how simple it is to execute. Image a snowball rolling down a hill that gradually increases in size and speed as it picks up momentum. Well, that metaphorical snowball is the amount of additional funds you’re able apply to each successive debt as you pay off the previous one.

Your smallest debt is the start of the snowball. When this debt is paid in full, you’ll want to roll that money over into your next smallest debt so that you’re now paying extra money on that debt which will help you pay it off faster.

The purpose of this strategy is for you to gain momentum as you knock out each of your debts – like a snowball getting bigger as it rolls down a hill.

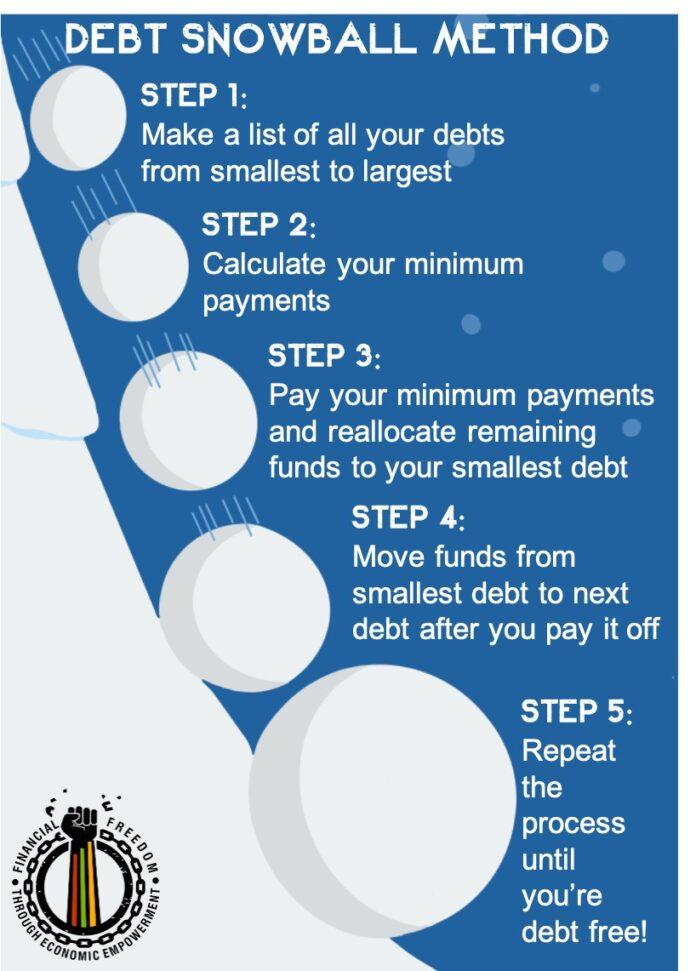

To break it down, here are five easy steps you can follow to start your debt snowball:

Step 1: List all your debts (credit cards, car note, student loans, etc.) from the smallest dollar amount to largest dollar amount.

Step 2: Start a second column and list the minimum monthly payment due on each debt. You should make sure you’ve budgeted enough money to cover the minimum monthly payments for every debt to avoid late fees and negative impacts to your credit score.

Step 3: Pay the minimum amount due on each debt every month. Add the remaining money you have left over after moving all your debt to minimum payments to paying off your smallest debt.

Step 4: Once you’ve paid off your smallest debt, add those funds to the minimum you were paying on your next smallest debt.

Step 5: When you finish paying off the second debt, rinse and repeat the formula until you’ve paid off all your debt!

What are the advantages and disadvantages to the debt snowball method?

As with everything in life, there are advantages and disadvantages to following any particular course of action. With that said, here are some of the advantages and disadvantages to consider when following the debt snowball method.

Advantages of the Debt Snowball Method

There are numerous advantages to using the debt snowball method to get out of debt, but some time-tested favorites are:

- The debt snowball method is a motivational program. Each debt you pay off will motivate you, and help you build the confidence necessary to tackle your larger debts. These small wins compound and serve as the building blocks to greater success.

- You’re more likely to stick to the plan when you can track your progress over time. While other debt reduction methods might save you money over the long-haul, they don’t provide the same level of feedback because you’ll be dealing with larger debt amounts.

- You will develop skills and habits while paying off your debt that will translate to other areas of your life. It takes patience, perseverance, and discipline to stick to a plan until completion. Not only will you be debt-free from following the debt snowball method, but you’ll also become a more resilient person.

Disadvantage of the Debt Snowball Method

There is really only one disadvantage to the debt snowball method, and that’s the fact that you’re not taking interest rates into the equation.

By not paying off your highest interest rate debt first you risk paying more money, over a longer period time. If that is a major concern for you and you believe you have the discipline, then you would be a good candidate for the debt avalanche method – basically the same strategy, but you pay off your debts with the highest interest rates first.

At the end of the day though, is there really any downside to getting out of debt no matter the minor inconvenience?

Conclusion

The debt snowball method is one of the best ways to pay off debt and build the confidence necessary to reach your financial goals. By paying off your smallest debt first and then attacking each succeeding debt with everything you’ve got, you’ll soon be live life on your terms!

Without any more debt payments, you now have the freedom to spend your money as you wish (we suggest building an emergency fund or investing in your future), freedom to do what you want without worrying about bill collectors, and no more obstacles holding you back from pursuing your dreams.

So, did the Debt Snowball Method work for you? Have any debt-free tips you would recommend for the Black Wall Street community? Let us know in the comments section!