Every August we celebrate National Make-A-Will Month! Making a will is often a topic that gets neglected in the Black community either because of the stigma of talking about death, or the lack of knowledge surrounding the topic.

In fact, according to a wills and estate planning survey conducted by Caring.com, a company that provides guidance for seniors and caregivers, “Roughly a third of all U.S. adults have a will…However, just 27.5% of Black Americans have one.”

That means over 70% of Black Americans don’t have a will. That figure also includes Black celebrities such as Bob Marley, Prince, Jimi Hendrix and Aretha Franklin who notably died without a will, leaving their families to fight over their estates in probate court.

So, in celebration of National Make-A-Will Month and the continuation of building Black wealth, lets discuss the ins-and-outs of a will, AND direct you to some FREE RESOURCES that’ll allow you to put together a legally binding will in as little as 30 minutes!

CONTENTS

Online Resources to create a will

Who should have a copy of your will?

*Only here to create a FREE will? Visit www.freewill.com or www.doyourownwill.com*

What is a Will?

A Will, officially known as a last will and testament, is a legally binding document that communicates your wishes for your estate after your death.

If you die without having a will in place, that is known as intestate. What that means is that the state in which you’re a resident will determine how your assets are distributed according to the state’s laws.

What Does a Will Cover?

The basic aspects of a will include the testator’s name (the person the will is for); address and marital status; and instructions as to which property goes to which beneficiaries. When it comes to your beneficiaries, a will’s primary purpose is to allow you to:

- Determine how your assets and personal possessions are distributed. You can specify who receives what, how they receive it, and when they receive it after your death.

- Direct your assets to non-family members. For example, if you want to leave money to a non-profit organization, charity cause, or your alma mater you can include that in your will.

- Designate guardianship. In your will you can designate a guardian if you have children that are minors at the time of your death.

Why Should You Have a Will?

A lot of people believe that because they’re young, or because they don’t have an extravagant amount of wealth that they don’t need a will – this couldn’t be further from the truth. If you’re over the age of 18 you need a will. Having a will:

- Prevents family conflict. You can avoid potential probate battles by specifying what everyone receives in your will.

- Eliminates confusion around responsibilities. You will need to include an estate executor or guardian for any minors in your will.

- Ensures your assets and personal possessions go to the people you want to receive them. You probably have more assets than you think: financial accounts, cars, furniture, clothing, books, electronics, photo albums, heirlooms, etc. all need to be distributed after your death.

Having a will can also protect your ability to pass down generational wealth after your death. “Without a plan in place, probate costs could be 3% to 8% of the value of an estate, said Brickson Diamond, a board member of Gentreo, an online estate-planning platform.” That is no small amount and can wipeout the gifts you’ve worked hard to passed down!

Types of Wills

There are numerous types of wills, but not all wills are created equally. Ideally, you’ll want your will to be signed by you, the testator; witnessed and signed by two individuals that are not beneficiaries in the will; and reviewed by an estate attorney to make sure the language is correct. This helps ensure your wishes are honored and your estate doesn’t get stuck in probate purgatory.

WARNING:

If your will is not witnessed, it can be thrown out in probate court because there is no one to attest to its authenticity. If that happens, your estate will be distributed according to your state’s intestacy laws.

With that said, here are some of the various types of wills you may come across on your path to building generational wealth.

Testamentary Will

A testamentary will is your best option because it provides the most protection against potential challenges from friends, family members, business associates, or any other claims on your assets.

A testamentary will is prepared and signed in front of a witnesses (usually two) and must contain:

- a clear indication that the testator is the maker of the will;

- a statement by the testator that they revoke any previous wills or codicils;

- a statement by the testator that demonstrates that they are of sound and mind and not under duress to dispose of the property; and

- a signature at the end of the will.

Holographic Will

A holographic will is a handwritten and testator-signed document, that does not need to be witnessed. The requirements for this type of will is:

- proof the testator wrote the will;

- the testator is of sound mind; and

- must include testator’s wishes for how assets will be distributed.

A holographic will may be difficult to prove in probate court because of legibility issues or proving that the testator actually signed the document since there are no witnesses present. These types of will aren’t accepted in all states because there are no witnesses.

Oral Will

An oral will is delivered verbally to witnesses, but isn’t written down. In most states an oral will IS NOT VALID. The bare minimum that is required by most states for a will to be valid is that it’s written down and signed by the testator.

In the few states that an oral will is valid, the idea is that the person is “suddenly in imminent danger of death and can’t make a written will, [so] the person’s last wishes can still be honored”. Even in these cases, it will still be an uphill battle in probate court to have these final wishes upheld in court.

Pour-over Will

A pour-over will is when all the property in your will is transferred to your trust after your death. The property is then distributed to the trust beneficiaries you named while you were alive.

Trusts, unlike wills, are private and that they don’t become public records after your death. This helps keep the details of who inherited your property more private. Check out this nolo.com article on pour-over wills to learn more about this type of will.

Mutual Wills

Mutual wills are typically used by married or committed couples to ensure that assets are passed down to their children rather than a new spouse if the living spouse remarries. This type of will is mutually binding, meaning that after one party dies, the remaining party is bound to the terms of the will – they can’t change it. You can only change the will after notifying the other spouse.

This type of will is generally not advised by estate attorneys because both parties need to be in 100% agreement of EVERY aspect of the will. While it might sound simpler to have just one will, it is advised that both parties have their own wills (which they can modify whenever they want and to their liking) and match the language if of the two wills if you’re on the same page.

Other Documents

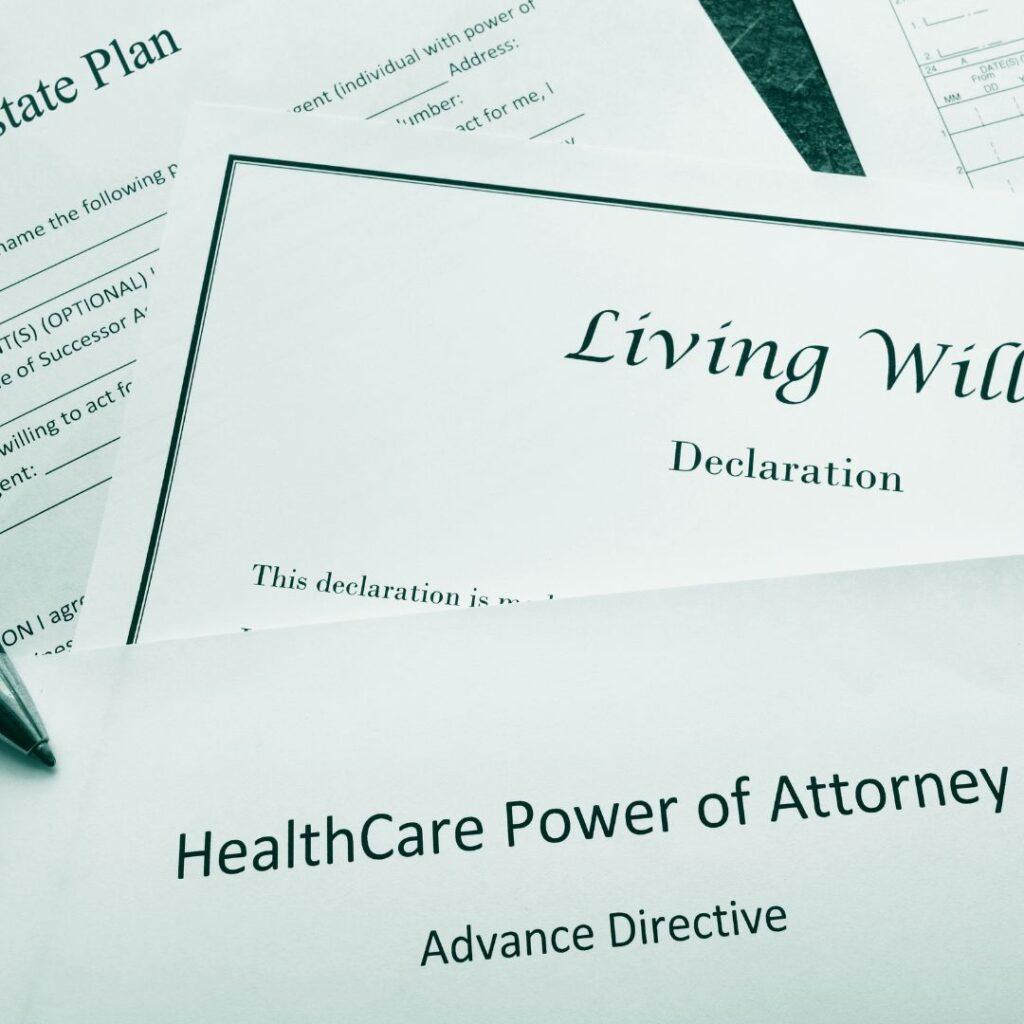

Besides a last will and testament, it is also prudent to create the following documents to accompany your will:

- Durable power of attorney: This document lays out who can make financial decisions for you in the event you are incapacitated.

- Health-care power of attorney: This designates someone to handle your medical decisions if you become sick and can’t make them for yourself.

- Living will: A living will expresses your wishes for medical treatments you would or would not want to use to keep you alive.

How Do You Make a Will

Making a will isn’t difficult. If fact you can create a will yourself just by following a few simple steps.

- Create a list of all your assets and liabilities. Examples of things that are considered assets:

- Bank accounts

- Investment accounts

- Storage units and/or lockboxes

- Family heirlooms

- Cars, boats, etc.

- Art work

- Personal possessions

- Life insurance

- Retirement accounts

- Anything you would want to pass on to a specific person

- Specify who receives what. If you want to leave personal property to a particular person, clearly state who that person is and what you’re leaving them.

- Have your will witnessed. Once you’ve drafted your will, you will need to have two witnesses that are disinterested (meaning they aren’t related by blood or marriage, and don’t stand to inherit anything from your estate) legal adults of sound mind watch you sign and date your will and then sign and date the document themselves. As long as they meet the aforementioned requirements, your witnesses can be a friend, coworker, lawyer, or even a neighbor.

- Choose an executor for your estate. This is the person that’s responsible for administrating your estate. Executor’s make sure that whatever wishes you had in your will are fulfilled. You will also need to name a guardian for any minors.

- Update your will. Estate attorneys recommend updating your will every 3 to 5 years, or after a major life event (marriage/divorce, birth of a child etc.).

While you can technically make a will own your own, consulting with a trust and estates attorney is the best way to ensure the language is precise, correct, and aligned with your state’s laws.

Online Resources to Create a Will

Making your own will might sound overwhelming, but luckily there are many paid and FREE(!!) online resources that can guide you along the process of protecting the bag for your beneficiaries.

Free Will Creation Websites

- Freewill.com. This site is 100% free through the support of non-profit organizations. They ensure that your data is encrypted, secure, and that your personal will never be sold. The best part is that you can make a complete will in only 20 minutes using their will builder!

- Doyourownwill.com. Similar to Freewill, one of the pros of this site is that you don’t need to create an account or provide a credit card to download your documents instantly for free.

Other Online Services

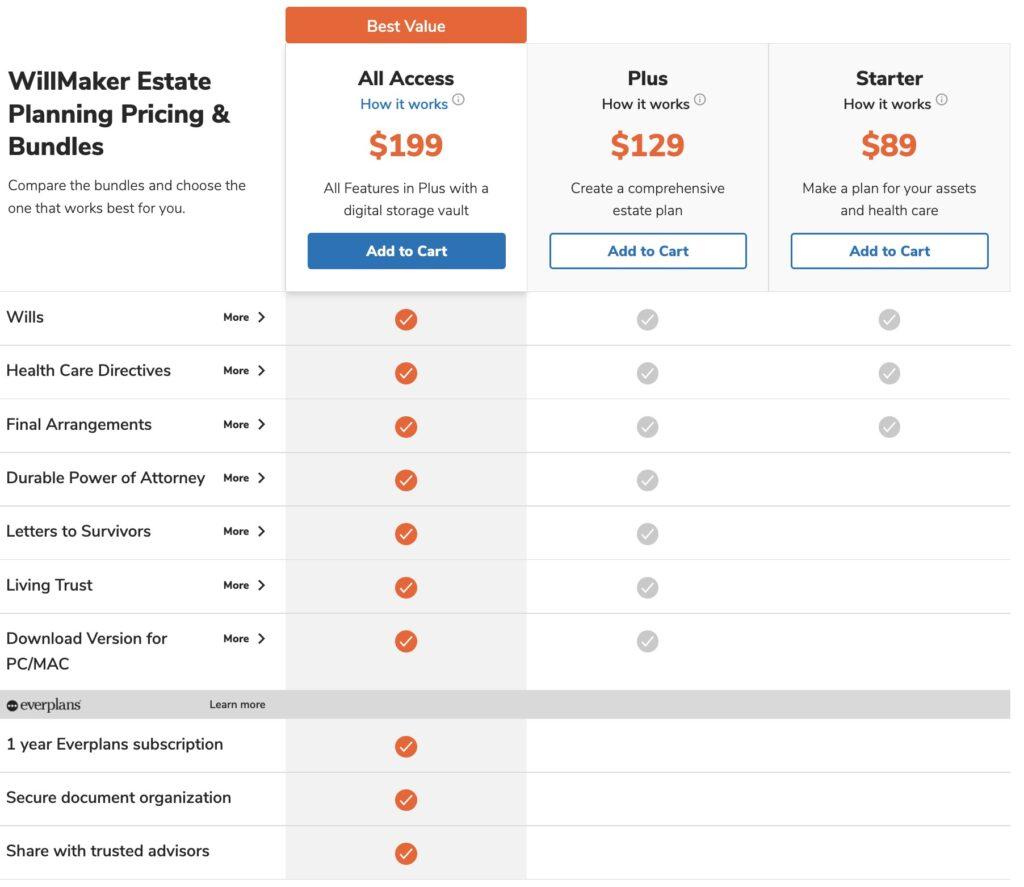

- Nolo’s Will & Trust. This is arguably the most comprehensive estate planning tool available online. Nolo’s Quicken WillMaker & Trust 2022 software grants you access to a library of estate planning, executor, home & family, and personal finance documents. All of their documents have been created and edited by lawyers to ensure that every document reflect the laws of your state. Nolo offers three bundles depending on your needs with prices ranging from $89-$199.

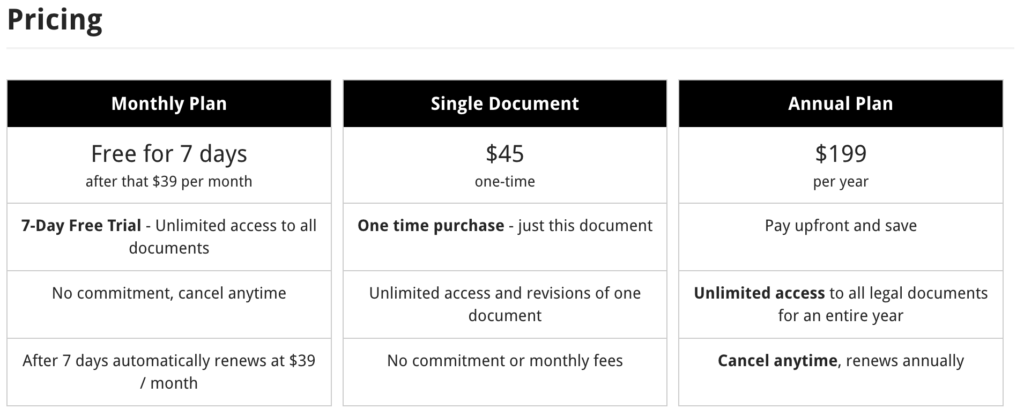

- Eforms.com. In addition to wills, Eforms provides you access to thousands of business, personal, and real estate documents. You can sign-up for one of their two subscription packages, or pay a one-time fee of $45 per document.

- RocketLawyer. Provides access to unlimited documents for estate planning and you can also have a lawyer review your documents at no additional cost. RocketLawyer offers a no-risk 7-day free trial and then $39.99/month for as long as you need it.

Who Should Have a Copy of Your Will?

Knowing who should receive a copy of your will can be just as difficult a problem to address as creating the will itself. On the one hand you want to make sure your final wishes are honored, but on the other hand you don’t want to potentially ruin any relationships with friends or family.

It is normally advised that you share your will with your estate executor, attorney, and beneficiaries – basically anyone affected by the will at the time of your passing.

You may be hesitant about sharing your will with your beneficiaries because it may cause family strife, but doing so creates the opportunity for your beneficiaries to ask questions, for you to clarify your intent, and to also let people know of any future responsibilities they might have such as paying for funeral costs or guardianship of minors.

If you choose not to share your will with your beneficiaries, at a minimum let someone know where to find your will and how to access it – ideally your estate executor. You also want to make sure the original will is stored in a safe place in your home (i.e., in a fire and waterproof safe), and having an electronic copy (along other important documents) as a backup wouldn’t hurt either.

Conclusion

After reading this article I hope you now have a better understanding of wills and know that the process of creating one isn’t as long, hard, or expensive as you might’ve first thought.

Having a will in place will help to avoid conflicts among your beneficiaries, protect your wealth for future generations, and create the peace of mind you and your loved ones deserve.