Credit cards aren’t inherently bad, but if you’re using them in any of these four ways you could be setting yourself up for major financial stress in the future.

1. You’re Using Credit Cards Wrong If You’re… Accumulating Consumer Debt

Don’t take on debt buying consumer items like trips or clothes that will drain your wealth rather than help you build it up. Debt should be used as a tool to invest in things that’ll accumulate in value over time such as investing in real estate, a business, or in your education.

If you find that you end up charging items to your credit card because of an emergency, check out our article, Everything You Need to Know About Building an Emergency Fund, to learn tips on how you can prevent emergencies from making you go into debt.

2. You’re Using Credit Cards Wrong If You’re… Carrying A Credit Balance

The fastest way you can take control of your financial future is to get in the habit of using your credit card like a debit card by paying your balance off in-full every month.

If you use your credit card only for convenience, to build good credit history, and to receive FREE benefits, you can get all the rewards of having a credit card without any of stress a lot of people experience from being in debt.

How to Increase Your Credit Score In 30 Days

The easiest way to make sure you don’t carry a balance is to NEVER use a credit card to finance a lifestyle you can’t afford if you had to pay out-of-pocket. If there’s something you want to purchase, but can’t afford it at the moment then you should create a budget and save for it rather than go into debt by financing it. You can check out our article on how to create a budget if you need pointers on getting started.

Carrying a credit card balance also comes at a cost, which leads us to our next point…

3. You’re Using Credit Cards Wrong If You’re… Paying Interest on Your Debt

The average APR for new credit cards as of March 2023 is 23.65%. That means if you carry the national average credit card balance of $5,221, you’ll end up paying a balance of $493/mo. for 12 months. During that time period you would’ve paid $572 in interest payments, and if you’re only paying the minimum amount, then you could be trapped in a debt cycle for years!

Life happens, but that doesn’t mean you can’t take control and escape getting caught in a debt trap. Check out our article on How to get out of debt using the Debt Snowball Method to learn a surefire way to get your debt under control.

4. You’re Using Credit Cards Wrong If You’re… Paying to Use Credit

Nowadays with so many credit card options in the market, there is no reason why you should be paying a monthly or yearly fee to access credit – no matter what your credit score is.

In fact, if your credit card isn’t REWARDING YOU with perks and benefits such as cash back, airline miles, or rewards points it’s time for you to go shopping for a new card.

Personally, I like cards that provide cash back. I have one card that gives up to 5% cash back for different categorized spending every quarter, and another card that gives 2% cash back on all purchases. Since I never carry a balance on my credit cards, I’m effectively getting paid every time I need to make a purchase!

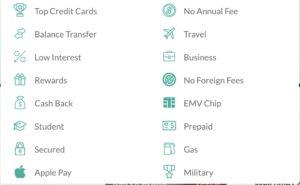

Sites such as lendingtree can help you find the perfect card credit for you by categories such as:

- Card category

- Card type

- Credit quality

You can also compare credit cards to make sure you’re picking the one that best serves your needs. Unless you want a specific card that charges an annual fee, there’s no reason why you should ever be paying to use one.

Final Remarks

Credit cards can be a burden or blessing depending on how you use them. If you can treat your credit card like a debit card, pay off the balance every month, and avoid paying for access to credit, you can literally make your credit cards work for you through rewards programs rather than you working for them.