Generational wealth has the power to change lives, but building it can be tough – especially in the Black community where many are the first in their families to be in a financial position to begin the wealth building journey.

In fact, a 2021 McKinsey report estimated that “the disparity in wealth between white and Black households was over $330 billion, with 60% coming from inheritances.” This quote highlights that most wealth is inherited, but the study also discusses how wealth can affect economic mobility and create an opportunity gap that leads to disparities in education, housing, and the ability to build wealth in the future.

The journey to build generational wealth will be difficult, especially if you’ve never seen it done before. But, by taking five simple actions to increase your wealth you can begin narrowing the opportunity gap and building generational wealth no matter where you fall on the income spectrum!

What is Generational Wealth?

Generational wealth is basically any wealth, both tangible and intangible, that you can pass down to the next generation.

For example, generational wealth would include financial assets such as:

- Cash and cash equivalents

- Real Estate

- Investments

- Businesses

- Life insurance policies

It would also include tangible and intangible assets such as:

- Family Heirlooms

- Photo albums

- Historical family documents

- Values and morals

- Good health and money habits

- Financial literacy and education

- Art work

- Jewelry

- Furniture

- Vehicles

- Books

The non-financial assets that you decide to pass down are just as important as the financial assets. Non-financial assets are typically the cultural traditions, family history, and positive lessons & values that will shape the character of the next generation.

Why is Generational Wealth Important?

The importance of generational wealth lies primarily in the fact that a family’s wealth effects the life outcomes of the next generation. For example, children from families with a high net wealth are six times more likely to become wealthy adults, and graduate college at a higher rate.

Generational wealth creates the resources necessary to propel us forward in life. Wealth opens the door of opportunity for future generations to:

- Avoid taking out student loans and accumulating debt in order to attend college or graduate school.

- Save and invest earlier in life so they have more time to build wealth.

- Purchase a home.

- Pursue goals and find fulfillment without money being the deciding factor in their decision-making process.

- Take more risks like starting a business or pursing a non-traditional career path.

When we control our own resources, we take control of our destiny and can build up our families to break cycles of debt and create cycles of wealth.

How do You Build Generational Wealth?

The keys to wealth building are simple: work to earn an income; spend less than you earn so you can save money; and invest your savings in your personal development, education, and in financial assets so you can generate more income and build more wealth.

In order to get to a point where you can pass on wealth to the next generation, you’ll need to acquire more wealth than you can use in your retirement. This requires you to have assets greater than your liabilities at the time of your death.

Five simple ways you can build enough wealth to pass down to the next generation is to:

- Invest in appreciable assets.

- Take advantage of life insurance policies.

- Create an educational savings fund for your children.

- Educate your children about personal finance.

- Create an estate plan.

Invest in Appreciating Assets.

The fastest way to build wealth is to invest in assets that generate passive streams of income. You can never outwork your money, because even when you’re asleep your invested money is busy building interest, capital gains, and appreciating 24 hours a day, 7 days a week, 365 days a year.

So, instead of working hard for your money, here are a few ways you can have your money work hard for you!

The Stock Market

An easy way to get started investing in the stock market is by investing in low-cost index funds or ETFs. This is a great way to start building wealth because index funds and ETFs provide long-term growth with low management fees that would otherwise eat away at your profits.

When I first began my wealth building journey, I choose index funds because they provided the diversification, exposure, and risk mitigation I was looking for without the need to do a ton of research and invest in hundreds of individual stocks.

I choose to invest in a fund like the Vanguard S&P 500 ETF (VOO) that tracks the S&P 500, because it practically guarantees the returns of the stock market which has a historical annualized return rate of 9-10% a year!

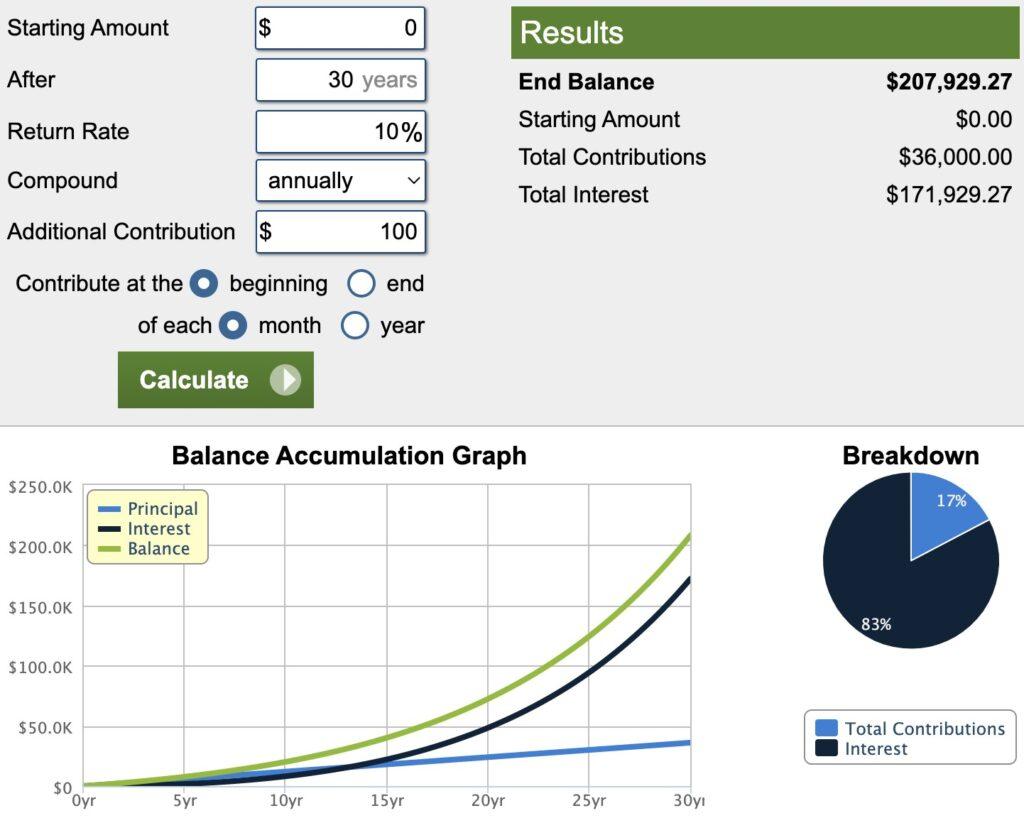

An example of what this looks like in the real world, is say you invest $100 a month, with an annualized return of 10%, over 30 years… You would net over $200,000 before inflation and fees! The amazing part about this is that you’ll only contribute $36k and $164k would come in the form of interest!

What this example demonstrates is the power of compound interest, and why the earlier you can start investing the more wealth you can build.

Real estate

Passing down real estate, usually a primary residence, is the most common form of generational wealth that is inherited. Owning your home can act as a forced savings account and allows you to build equity in the property. Investing in rental properties can also provide the same benefits as owning your primary residency with the added potential to provide a steady cashflow from rental charges.

If you don’t want to own physical properties or deal with the headache of being a landlord, you can still make passive income from real estate by investing in REITs.

REITs are a low-barrier way to get exposure to real estate investing without the need to manage properties yourself. A REIT, or Real estate investment trust, is a company that owns incoming-producing real estate that you can invest in (similar to investing in a mutual fund). They usually have a high dividend yield with the potential for capital appreciation as well.

401K and Retirement Accounts

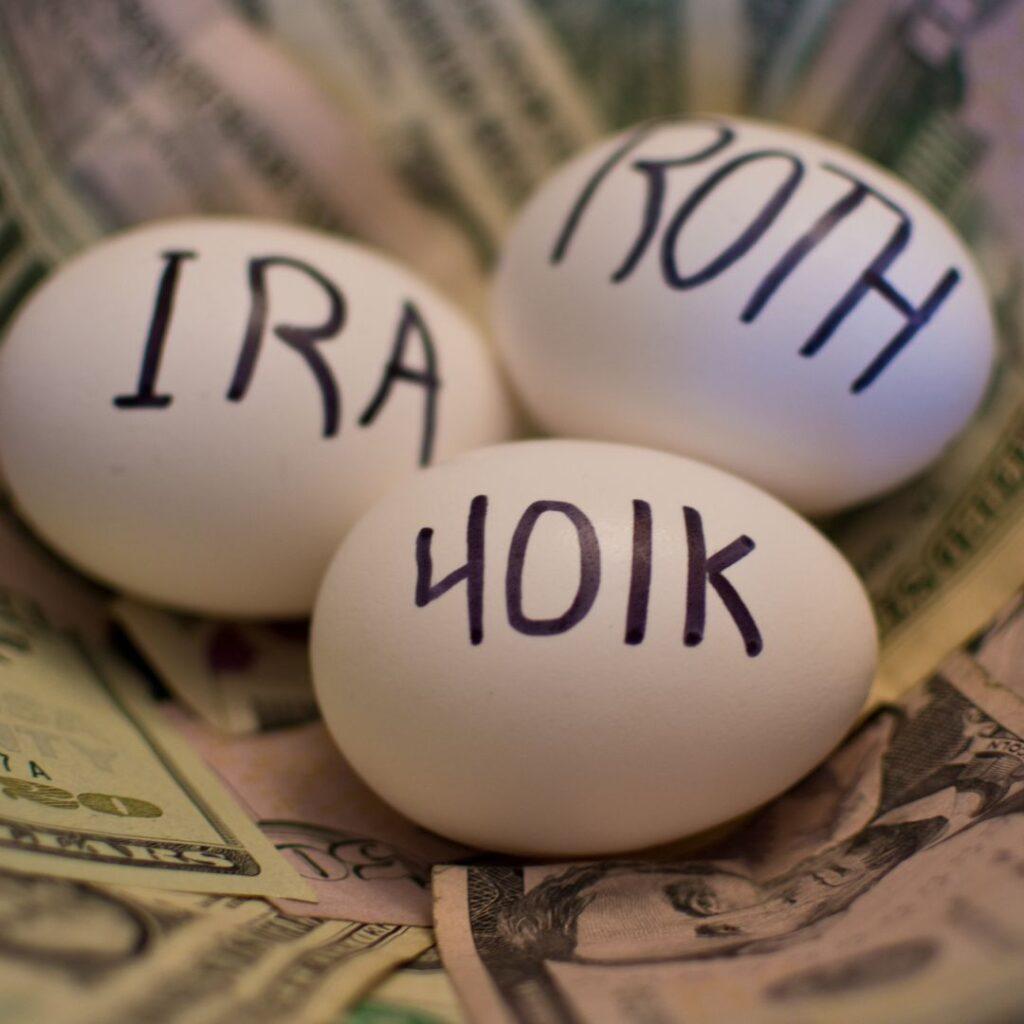

An easy way for you to build wealth is by maxing out retirement accounts such as a 401K and Roth IRA, especially if your company matches.

A 401k allows you to contribute pre-tax dollars directly from your paycheck into a retirement plan which reduce your taxable income and may come with a match from your employer. Contributions to a Roth IRA are made with post-tax dollars, but your investment will grow TAX-FREE! You should also name beneficiaries on these accounts to designate who will receive the funds if you die prematurely or before your benefits are fully distributed.

Building generational wealth can be a tough process, especially if you’re worried about saving for retirement as well. Make sure you take full advantage of any company matches your employer offers, and that you max out any tax-advantage retirement accounts available to you. Saving a little extra money now will go a long way to allowing you to enjoy retirement with draining your other financial resources in the future.

Take Advantage of Life Insurance Policies.

Life insurance policies pay out a sum of money to beneficiaries of the insured person. This is an excellent tool to provide a financial safety net for your family – especially if your death is untimely or you were the family breadwinner.

Create An Educational Savings Fund for your Children.

Besides a mortgage, student loan debt is the biggest expense most people will take on during their life. Image the freedom you can create for your children if you can help them start off their adult lives without 10’s to 100’s of thousands of dollars in student loan debt.

Two tax-advantage approaches you can take to begin saving for your children’s education is a 529 account or education savings account (ESA).

A 529 account is a state-sponsored tax-advantaged investment plan to encourage people to save for educational costs. No taxes are applied to earnings or qualified withdrawals, but there is a 10% penalty for any unqualified withdrawals of funds.

An ESA lets you save for future qualified higher education expenses such as tuition, fees and room and board. These funds can be used at any college or university, and the “education savings plans can also be used to pay up to $10,000 per year per beneficiary for tuition at any public, private or religious elementary or secondary school.”

If you want more control to determine how your funds for your child’s education are invested or used, consider opening a custodial account. A custodial account is an investment account that you control until your child is no longer a minor. This type of account doesn’t provide the same tax-advantages of a 529 or ESA, but if your child choses a path other than higher education you won’t be hit with a huge tax penalty.

Educate Your Children About Personal Finance.

We have all heard stories about lottery winners or athletes blowing through fortunes all because they lacked the knowledge to make wise financial decisions. Well, if you don’t teach your children about personal finance, there’s no guarantee that they won’t do the same when it comes to the inheritance you plan to leave them.

One of the easiest ways to ensure that the wealth you built is managed properly is by passing down the knowledge you used to build it: creating a budget, saving money, investing, and having an enterprising spirit.

At the end of the day, you can’t expect your kids to know how to manage wealth if they were never taught how. That’s like asking someone to prepare a 5-course meal that has never cooked a meal before.

If you want to learn where to start with teaching your kids about money, check out our article 10 lessons to teach kids about money.

The great thing about teaching kids about money is that you can start while they’re young and spread the lessons out over time. You can then gradually increase the level of sophistication as their knowledge base grows.

If you’re not inculcating good money habits in your children from an early age, you could be missing out of an opportunity to change the trajectory of lives forever.

Create An Estate Plan.

An estate plan is a set of legal documents that instructs your estate how, and to whom, you want your assets distributed after you’re deceased. If you do not have an estate plan in place at the time of your death, your assets will be distributed according to the laws governing your state.

Everyone should have a will no matter their age or health to avoid conflicts or confusion amongst your loved ones once you’re no longer around to make the decisions about your estate.

If you want to learn more about will’s, check out our article on how you can make a FREE will in as little as 30 minutes!

Conclusion

Building generational wealth doesn’t happen by accident. It takes dedication to something bigger than yourself to build a lasting legacy, but the effort you put in now will reverberate across generations to come!

By investing in appreciating assets, taking advantage of life insurance policies, creating an education fund for your children, teaching your kids about personal finance, and establishing an estate plan before you past, you’ll be able to rest assured that your family will continue to thrive long after you’ve move on.